(c)iStock/Martin Prescott

SEO has always been a challenging channel to understand concerning ROI; trying to attribute sales is almost impossible and functionality is driven through tactics.

It has left marketers in a situation where they know they will need to invest but are unsure how to quantify investment and predict expansion.

Attribution is made because of the fact Google moved to stable hunt in 2013, resulting in marketers information that was keyword.

Challenges were introduced this year when Google started to use ‘close versions’ to display key word search volumes, meaning you don’t have an accurate picture of the industry size.

Fortunately, there are workarounds to the latter but we are in a situation where we don’t know what’s driving operation.

So, what exactly do we have to try and solve the problem of forecasting and ROI?

Firstly, we could become ranking info this means we could know with some accuracy where we’re currently looking on Google for specific search phrases. In Google Search Console we can see traffic stats to these along with impressions and much more importantly click.

As a starting point for preparing a forecast for SEO this information has been used by us at Branded3. Below are the steps we go through to put this together.

Keywords

The very first step is pulling together some purposeful data; as they relate to your services and products it needs to be substantial enough to supply a decent shot of your market place, covering the keywords.

The number of keywords will rely on the dimensions of your business, 500 keywords may be acceptable for a niche retail business, but a number of our clients in the financial sector may use up to 10,000 key words to map out a precise forecast.

There are lot of tools for discovering keywords, Google Keyword Planner is still the favourite, but if you want more info about your key words and competition, you could use a paid tool.

Ranking Data

You need to use a rank checking tool to understand that your visibility to your keyword set you’ve chosen. I would not advise using any position info because it not a true reflection.

We use Advanced Internet Rankings and have found it to be a platform for comprehending rankings on both desktop and mobile search.

You need to be left with their applicable position on Google, search volumes and a spreadsheet containing all of of your keywords when you have pulled this data.

We now need to employ a click through rate version to the set in order to understand how much of the traffic we receiving.

CTR Designs

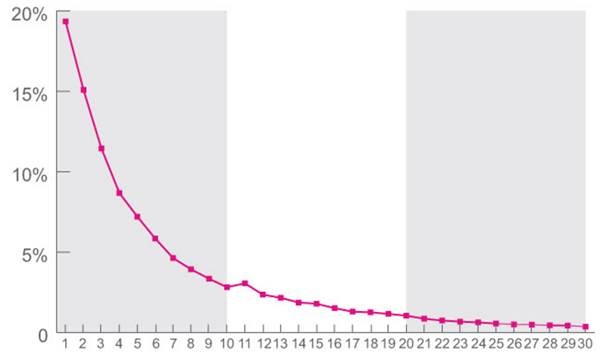

That is where things become particularly difficult since there is not any method to get to a CTR model that’s 100% accurate. Until recently we used a generic version from SlingshotSEO which suggested an 18 percent click through on Google in CTR at place and place 1.

However, we have recently had to change the version due to changes in the number of advertisements on Google, increasing clicks on advertisements and compelling organic results down, and also we found a model to be accurate.

We now use the Netbooster CTR version which gives a CTR to rank 1 and reveals CTRs as far down as page 3 to Googles search results.

You can use the CTR model to comprehend even, or how much of the prospective quantity you’re achieving.

You should end up with a record that looks something like this:

As you can see from the preceding, the maximum traffic possible within this marketplace is 2,361 visitors based on a maximum click through rate of 19%. However, due to current rankings we’re only realising 305 traffic or circa 13% of accessible traffic.

So we’re now at a stage where we’ve gathered data, volumes, rankings and click . In addition, we understand according to our current visibility we have a traffic share of about 13% of the 2,361 potential sector.

Forecasting Growth

We need to make some estimates based on competition and investment. If there is a sector competitive 3-5 % traffic share growth is typical, if it is less competitive or you are investing significantly afterward 10-15 % is feasible. It requires some guess honesty and work in terms of your investment in connection.

When forecasting over a 12 month period you should take into consideration:

- Seasonal tendencies based on analytics

- Any product launches

- Brand expansion & ATL spend

- Market tendencies

When you have settled you can then plot out the way you expect the expansion to be delivered over a 12 month period. You could add estimated cost per click quantities to show the traffic would cost to buy each 31, if you want to strengthen your business the event.

There is not any way to forecast SEO with accuracy this guide is great starting point to know your market size and the possibility of growth.